NPRs: Short-term pain, long-term gain

If you generate enough wind, even pigs can fly. The Canadian economy was able to avoid a full blown recession only due to the meteoric ascent in population growth in the past few years. The resulting dramatic changes in both the size and as importantly, the shape of the Canadian age pyramid, are having a significant impact on the way we should interpret current and future economic variables and what their implications are for monetary and fiscal policies. The youth dividend Canada is currently enjoying (as opposed to many other OECD countries) might, in time, prove to be a major asset.

Zooming in on the denominator

Widely followed benchmark economic statistics such as output and labour market variables are frequently expressed as a share of population or the labour force. These ratios create the headlines with their “top line” growth or contraction. But to what extent do we pay enough attention to the denominator of the equation?

Canada’s population has grown by 3.2 million or 8.4% since mid 2021, and by no less than 5.6 million or 15.7% since late 2015. In January 2024, the 3.2% annualized growth rate was the highest seen since 1957.

However, unlike the baby boom period, over 95% of recent growth is from arrivals from abroad that require services and housing immediately upon arrival. These new arrivals are predominantly aged 15-54, much younger than the rest of the population. Most of those are destined or aspiring to be part of the labour force.

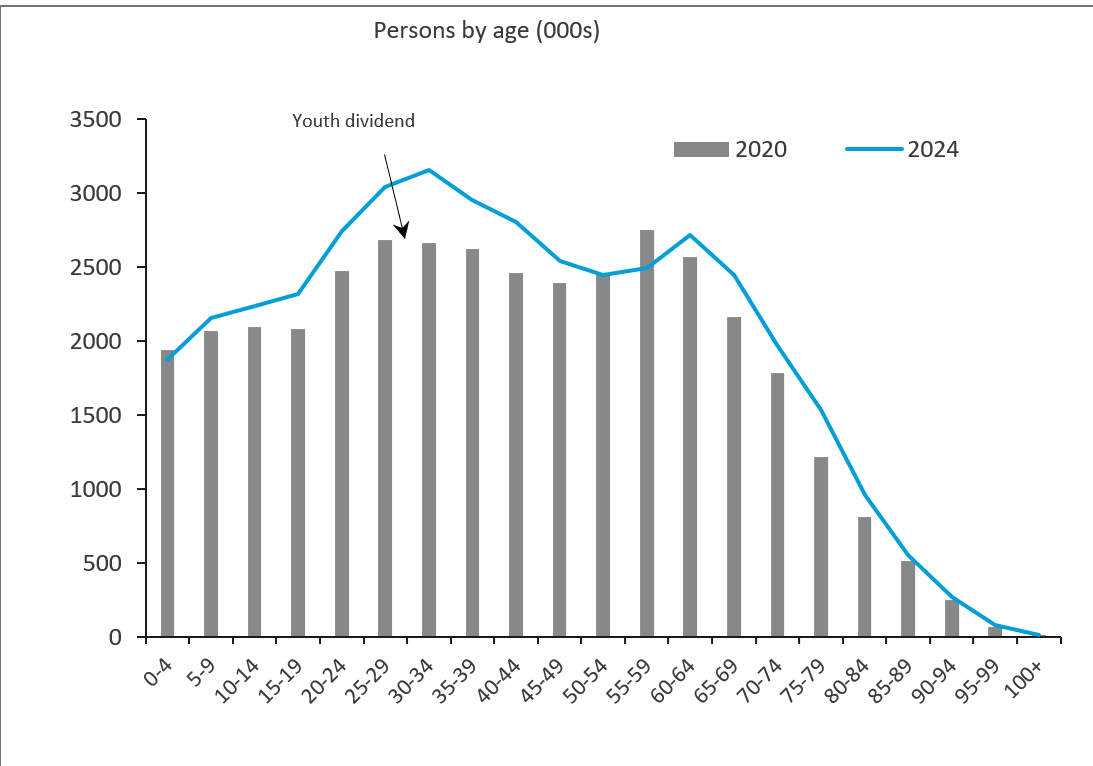

Chart 1 illustrates the significant change in our age pyramid as a result of international arrivals since 2021, and the distinct age profile that international migrants have compared to the total population in 2023/2024. Simply put, the Canadian population (and labour force) was much younger in 2024 than it was in 2021, as a result of the distinctly younger profile of international migration. Never before have we seen such a dramatic change in the age pyramid in such a short period of time.

A larger and younger population should create new opportunities for employers and generate greater household demand. One should not underestimate the lasting impact that the recent trend in population growth will eventually have on labour supply, output, productivity, and the dependency ratio.

After all, at around 3 million, the NPR population is larger than that of six of Canada’s ten provinces. Consideration of this population realignment and assumptions around retention of population are crucial to macroeconomic forecasts along with estimates of potential growth and R star.

Capital dilutions

However, for the here and now, the public and policy backlash to immigration and NPR growth was spurred by the greater scarcity that accompanied that growth. A pre-requisite for rising per capita output occurs when an individual joins the workforce with skills that match demand and secures or creates a job that increases output and earnings above the average.

‘Capital dilution’ occurs when populations expand so quickly that the state cannot provide its own citizens with functioning public services, and along with developers, cannot provide enough new housing. Unplanned population growth places enormous pressure on governments already struggling to provide public services for its existing population. With the sheer scale of the population/capital mismatch in Canada, the public backlash was both predictable and inevitable.

Increasing human and especially physical capital takes time and planning. Acquisition, deployment, and integration of physical capital, with the other elements of multifactor productivity at the firm level, is a complex interplay of considerations of forecasting, risk, and reward. The prospects of adding productivity increases with planning and the integration of human and physical capital.

Unfortunately, as we have indicated in previous research, close to half of the growth in population in the past decade, and an even higher share of the growth since 2021, was not forecasted by Statistics Canada, and was not planned for. Decision makers did not have the information to plan for the surge in population and labour supply, resulting in a subpar capex decision making process. What’s more, the skills of new arrivals are not properly measured. Rather, arrivals are asked about “intended occupation”, resulting in a significant occupational mismatch in the job market. Note that the slowing in capital investment mirrored the spike in population growth. Add to that mix the current Trump related uncertainty, and you have no reason to expect a surge in business investment in the near term, further deepening the capital/labour mismatch.

According to recent study by Philip Smith, former deputy chief statistician at Statistics Canada, since Q2 2022, the largest drag on productivity was the declining share of permanent residents in the total population. The second largest drag was the NPRs composition of labour, reflecting the fact that new arrivals on average make less per hour than the average Canadian resident. In fact, the overall impact of NPRs on GDP growth is different from that of Canada’s PRs. NPRs’ average productivity is likely to be lower as they tend to work in occupations paying below average wages. In addition, NPRs tend to work fewer hours. If it was not for the surge in the number of NPRs in 2023, GDP in that year would have only grown by an estimated 1.1% vs. the official figure of 1.5% (Chart 2). While growth in GDP per capita would have been mildly positive.

Long-term gain

Due to the recent government response, the pace of NPR arrivals is expected to slow down notably in the coming years, although not by as much as predicted by official numbers. For reasons we have spelled out elsewhere, policymakers and analysts cannot assume that the over one million current temporary residents in Canada with expired visas will simply leave the country over the next two years. In other words, the demographic change of the past few years is not about to reverse.

Economic theory and common sense suggest that that is a good thing. After all, an aging population is viewed as a major drag on productivity in most OECD countries. The youth dividend enjoyed by Canada is unique. Yes, clearly it has been too much of a good thing in a very short period of time.

But from a longer-term perspective, retaining and integrating current immigrants and NPRs would result in stronger potential growth and improved productivity, as more new arrivals find employment closer to their skill level or add to their skillset. If as a society we manage to create the conditions for better integration of NPRs in the labour market over time, we should be able to reverse the negative trajectory in productivity growth of the past few years.